What does an unclosed gap mean on the stock exchange? What is a gap and its analysis? Features of the gap on Forex and other financial exchanges

This article will help novice traders expand their knowledge about trading in financial markets. In particular, we will talk about one situation that many have probably seen more than once - the chart shows a gap between the previous candle and the new one. That is, there is absolutely nothing between them. This phenomenon is called GEP. It is common in stock markets (exchanges) and Forex. Next, we will take a closer look at the decoding of this word, the types of gaps, and tell you how to trade it correctly so as not to incur additional costs.

What is GAP

The gap is a small gap between quotes. This is how gap is translated from in English- gap or gap. It is shown on the chart as an empty space between the previous and new candle. A gap is formed as a result of a sharp change in value in one direction.

Professional traders, talking about what GAP is, give 4 options for this gap. Each of them is deciphered differently and has its own characteristics. Therefore, in order to increase the likelihood of making a profit in trading, you need to learn how to correctly distinguish between them.

GAP breakthrough or Breakaway gap

This type of gap occurs when there is a large trading volume in the financial market, when the value of an asset goes beyond the congestion of the market.

Entry rules. In order to profitably trade the signal of such a gap, it is necessary to carry out the analysis correctly. First of all, they monitor the volumes. If they are still large after the gap appears, then the likelihood of its filling is unlikely. But if the last price moved away from the previous price at a low level, then there is a chance that the gap will be closed.

General gap

In English this abbreviation is written Common gap. This gap has many meanings in trading - area gap, gap gap, temporary gap. A common gap occurs when there is active trading in the market between support and resistance levels. At the same time, the price at such moments most often moves inside some channel, that is, there is no clearly visible trend either up or down. The price fluctuates within the range. In the Forex market, a general gap can appear even with large volumes.

Entry rules. Most often, the price strives to close the gap - it goes either up or down. If the gap has closed, then it will become difficult to further analyze the chart, since the price will behave unpredictably.

Exhaustion gap

GAP at the end or in other words, rupture of exhaustion. Most often it is a signal of the end of a trend. In this case, the gap occurs due to a rapid and direct decrease or increase in the price of the asset.

Entry rules. If the gap appears at the very top of the trend with large volumes, then the probability of the price movement fading in the original direction is extremely high. Most likely, asset quotes will move in the opposite direction. But it should be taken into account that this signal is not a 100% guarantee of a trend change and that you need to open a trade in the other direction. The price may simply go flat between any levels, that is, trading on this asset becomes inactive.

Continuation gap or running gap

This type of signal cannot be found in sideways price movements or at the end of a trend. It appears in the middle of a rapidly moving asset up or down. A running gap is usually not closed by the chart, but remains open.

Entry rules. Continuation gap is great for identifying the middle of a trend. You can almost find out exactly how many points the quotes will still rise or fall.

| Brokerage office | Min. deposit | Min. bid | Bonus | Demo account | License |

| Binomo | 10$ | 1$ | Up to 100% | Yes | TsROFR |

| FinMax | 100$ | 5$ | Up to 150% | Yes | TsROFR |

| Migesco | 5$ | 1$ | Up to 110% | Yes | TsROFR |

| Binarium | 9$ | 1$ | Up to 60% | Yes | TsROFR |

| 24option | 200$ | 24$ | Up to 100% | Yes | IFSC |

Features of the gap on Forex and other financial exchanges

Once you have figured out what the abbreviation GAP means and what types there are, you need to better understand its properties.

Please note: Knowledge of all trading factors will allow you to more enter into profitable transactions and reduce the risk of losses. The ability to correctly identify the types of gaps and the reasons for movement in one direction or another helps to more accurately identify the future direction of the trend.

Why is GEP formed?

The first thing that is worth examining in detail is what causes the gaps to appear. Judging by the reviews of professional traders, it is impossible to determine exactly the reason for its formation, since it is unpredictable.

But, nevertheless, there are several factors that are divided into several groups:

- News. The release of important news in some cases provokes a strong change in the price of an asset, which should always be taken into account when trading at this time. Such news includes information about a change in interest rates or the release of a high-ranking person with an important statement. For example, statements by people such as the heads of the Central Bank of the Russian Federation, the ECB or the Federal Reserve can reverse the trend of an asset or intensify its movement.

- Unexpected events. This group includes all those events that no one can predict, but at the same time they significantly affect the price of the asset. Such events include terrorist attacks, natural disasters or disasters caused by human error. You should be extremely careful when trading at this time.

- Breaks in trading sessions. In this case, the gap appears on the chart due to a large accumulation of orders after the closing of the trading session. Congestion occurs due to trading during certain periods or a malfunction in the functioning of the market. For example, a gap may form on an asset on Monday due to a stop in trading on the financial market over the weekend.

- Trend gap. Appears extremely rarely. For such a gap to form, important information must spread among traders at tremendous speed. Because of this, a large number of people dramatically change their trading strategy every hour.

The gap is not always filled

Reading articles about trading, you can often come across the belief that after the gap signal appears, the price tends to fill the empty gap. That is, the gap is always filled. This statement is only partially true when trading Forex. Most gaps, approximately 70-75%, overlap either immediately or after some time. But even then, this figure is not supported by any facts or research, but only an approximate estimate by specialists.

- The gap must be at least 20 points in size, otherwise there is no point in trading it.

- Orders should be opened only after at least half an hour, not earlier.

- If you are not sure that the gap transaction will close in positive territory, it is better to ignore such a signal.

- The minimum Stop Loss size = Take Profit x 1.5, that is, if the Stop Loss is 30 points, then the profit is set at least 45 points.

For traders trading the Russian ruble, it is quite easy to detect gaps. Trading on this asset takes place in sessions, the interval between which is very long.

conclusions

It's worth repeating that not all gaps are covered by the graph. There is no need to open an order every time you see a gap - this is one of the most common mistakes novice traders. You should open an order only when you know exactly what type of gap has formed and how to trade it.

Follow the rules of money management. You should not bet half of your deposit on one trade. If it brings a loss, then your account will be reduced significantly. Be sure to set Stop Loss according to the previously stated rule. It plays the role of insurance, which will help reduce the amount of losses.

Trade only strictly according to plan, and no emotions, even if before that you had a series of profitable orders.

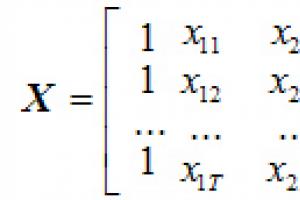

If you are just starting to explore the Forex market, then you may have already encountered such a concept as a gap. What is a gap on Forex or any other financial markets? The very meaning of the word gap comes from the English gap, which means “gap”. So, a gap in technical analysis means a significant break in the flow of quotes. If you look at a gap on the charts, you will see a gap between the closing price of one candle and the opening price of the next candle - the closing price and the opening price are at some distance from each other, which clearly stands out on the chart:

Rice. 1. The price gap on the chart is a gap.

Such gaps or, as they also say, price jumps and are called gaps. Any trader should know about the specifics, possible reasons the occurrence and consequences of gaps.

Causes of gaps.

What is a gap and what are the reasons for its occurrence? There are several reasons why gaps occur in Forex. The most common reason is a technical one - an incomplete flow of quotes arrives at the trading terminal. As such, such gaps do not have any significance or influence on trading processes.

Sometimes gaps on Forex can appear on holidays, at the time of exit or on the closing days of a month (year), both in the foreign exchange and in commodity, stock or other financial markets. By the way, at the time of the release of important economic news and on the closing days of the month, Forex often experiences sharp price jumps, in both directions, so trading in such cases is strictly not recommended unless you clearly understand what you are doing.

A gap can happen on hourly, half-hourly and other time frames (within one) without, it would seem, visible reasons- and this will be a random gap, and not a signal to any further direction of price movement. Please note that it is the gaps that cannot be taken into account, and not the reasons that contribute to their occurrence! Such gaps happen quite rarely. The reasons for their occurrence can be events such as serious terrorist attacks, major disasters, coups in leading countries, since these reasons still directly or indirectly affect the economy and exchange rates. An example of such an event is the explosion at the Fokushima nuclear power plant in 2012, which immediately led to the emergence of gaps and a prolonged fall (growth) of many currency pairs.

The other case is more important and involves the formation of a gap in a continuous flow of prices as a result of fundamental events. These are the gaps you need to pay attention to first!

Depending on the type of market, a period should be understood as different periods of time. For commodity markets, the period will be 1 day, since trading on them is carried out during a certain part of the day. In the Forex market, a period can already be considered 1 week, since trading on it is carried out around the clock, with the exception of weekends. And on weekends, informal meetings of major bankers, finance ministers and other leaders in the global financial sector are not uncommon. As a result of their decisions and statements, significant price changes follow, and, consequently, the emergence of gaps at the turn of two weeks. These are the gaps that are most important for trading, so let’s take a closer look at what consequences a trader can expect as a result of a gap from Friday to Monday.

Consequences of gaps at the turn of two weeks.

So, let's assume that you have an open buy order at a price of 1.3000, a take profit at 1.3050 and a stop loss at 1.2980, and today is Friday. The market closes at 1.3040. What does this order expect when the market opens on Monday if there is a gap?

- Option 1 - the market opened with a gap down. As you remember, according to the conditions of the example, the market was closed at a price of 1.3040. And it opens at a price of 1.2900 - as they say, it “hit” down. Do you think the order will be closed by stop loss and you will lose only 20 points? You're almost right, but not quite. The stop loss will work, but at the market opening price and you will lose 100 points, not 20 as planned;

- Option 2 - the market opened with a gap up, at a price of 1.3090. And the take profit order will work, but again, at the market opening price, the profit will be 90 points versus 50 expected.

Therefore, every trader should know that the Friday gap closes orders not according to the level of the set stop/profit, but according to the market opening level!

To combat the Friday gap, before the market closes, you can remove stop losses and take profits. Or set their values that the gap definitely cannot reach - for example, 1000 points from the order opening price. And at the moment the market opens on Monday, return them to the values that the current situation dictates.

That is why on Friday gaps (or gaps at the junction of weeks, as they are also called) you can both lose and make money. If an order was opened before the weekend, and after the weekend a gap appeared in the desired direction, then such a short-term position will bring unexpected profit, which should be fixed in time. In most cases, after a gap, the price continues to move in the direction of the gap for some time, which means you can earn even more by leaving the deal open until the gap begins to be compensated and the price begins to reverse. And a price reversal after a certain period of time after the formation of a gap occurs in 70% of cases:

Fig.1. An example of a price returning to the closing level of the previous period after a gap.

Fig.1. An example of a price returning to the closing level of the previous period after a gap.

But it happens that the price continues to move in the direction of the gap and is not compensated. And this situation is a real gift for traders who trade using medium- and long-term strategies and who have previously opened positions in the corresponding direction.

If a gap occurs against an open trade, but does not reach the established stop loss, then the new week for the trader begins with troubles. Should I close the position with the current loss or wait for the price to reverse and return to the gap after some movement? The probability that something will happen and the trader will find himself out of the market is very high if you do not know how to manage such situations and do not follow.

Believe it or not, there are strategies based on gaps! It will be very useful to familiarize yourself with them, since sooner or later every trader encounters such a phenomenon as a gap and you need to be able to react correctly to it. And in order to make money on such a phenomenon, and not lose, you should have certain theoretical knowledge of what a gap is, and at least one gap trading strategy in your arsenal.

In the Forex market, a gap is a fairly common phenomenon, and it represents a sharp jump in prices. However, some market participants know little about where such jumps come from, and also how one can trade on them, because in fact, everything here is far from being as simple as it may seem to many at first glance.

The gap itself is the difference between the price that was present when the market closed on Friday, as well as its subsequent opening on Monday.

Trading strategy

In this case, the currency pairs used are GBPUSD, EURUSD, GBPJPY and EURJPY. The probability that the gap will close is approximately 70%. You can begin trading approximately half an hour after the market opens at the beginning of the week. Experts recommend such DCs as RoboForex and Alpari to traders.

What it is?

If translated literally, the gap is the difference or gap between quotes on Friday and Monday. If this difference is quite significant, a considerable jump is formed, that is, the price is quite overestimated or underestimated in comparison with the previous one, and this is clearly visible in the charts. It is precisely such gaps that form different kinds GEPs.

It is quite natural that such gaps do not always appear, but on each pair you can see them on average approximately once a month. Sometimes less often, sometimes more often, the fact remains that types of gaps appear periodically, so you can and should make money on them.

Why do they appear?

GAPs are a consequence of the fact that during the time during which the market remains closed, a fairly large number of buy and sell orders accumulate. After the market opens on the night from Sunday to Monday, such orders completely collapse and form a spike.

Of course, this does not always appear, but only if there is a significant difference in the sell or buy orders that accumulated over the weekend. Market makers notice a significant number of sell or buy orders, as a result of which a price appears that is visually lower or higher than the market values at the close of last week. It is worth noting that it is enough important point- in the vast majority of cases, the use of gaps in trading on the Forex market constantly tends to close.

Example

The market opened an order of magnitude higher compared to Friday’s close, but at the same time it went up for a certain time, but after that it turned around and began to fall. This situation arises all the time, that is, after a gap appears, the price begins to quickly tend to completely close the formed gap.

In other words, if we consider what a gap is and its analysis when the price rises, then the price will move down extremely quickly so that this jump is completely covered. If the difference goes down, then the price will increase to close such a gap.

Why are they closing?

If the market at the opening has too large a difference in price compared to Friday, a large number of all kinds of orders appear, as well as for sale or purchase. Accordingly, the stops of each individual order are located close to the price that was on Friday. In this case, market makers, who perfectly understand what a gap is and what types of gaps exist, begin to knock out stops of these orders triggered at the market open, thus taking money for themselves.

After the difference is completely covered, the market may turn in a completely different direction, and there are no specific patterns for this phenomenon. In general, all gaps tend to close as quickly as possible, but often there are also price jumps at the opening on Monday, but they do not stop, but only continue to grow. Such situations occur only if there is a very, very serious trend movement or some fundamental factors come into play. For example, this happens if there are some serious changes in the economy over the weekend. Thus, the definition of a gap suggests that they tend to close, but not always, and this should not be forgotten in the trading process.

How to trade?

It would seem that in this case there is nothing complicated - it is enough to simply sell or buy towards the closing of the gap after the market opens, that is, in principle there is nothing to think about here, but in reality everything is not as rosy as it might seem at first glance. First of all, we should not forget that not all couples demonstrate the correct development of gaps, and in addition to this, there are also some patterns in the inputs. Also, do not forget that you need to define a “stop loss,” because a situation often occurs that the price begins to move in the opposite direction before closing the gap.

What should you pay attention to?

Not all trading pairs offer truly high-quality execution of gaps, that is, closing after they occur. The most optimal (approximately 70%) pairs are GPBUSD, EURUSD, GPBJPY, EURJPY. The chance of closing the gap on such pairs reaches 70%, and in the case of EURUSD, the chance of closing is minimal among all pairs. Thus, if in this pair the chance is 66%, then in others, as mentioned above, up to 71%.

Thus, if you are interested in what a gap is and what strategies exist on gaps, first of all you will need to track these four pairs, and even completely exclude the EURUSD pair, leaving only three pairs, while others don't pay any attention.

In this case, you can use almost any time frame, but often experts use M30, where each candle lasts half an hour. Trading time on the system is carried out only once a week in the event of a gap appearing on the market.

How to proceed?

First of all, after Forex opens, you will need to check whether there is a jump in price, that is, whether there is a significant difference between the closing price on Friday and the price that is present during the opening on Monday.

If there is a gap, then it should be at least 20 points. If it reaches only 10-15 points, this indicates insignificant fluctuations, and you should not focus your attention on them. In the vast majority of cases, professional traders recommend considering a gap of at least 20 points as a gap.

You need to enter the market not immediately after the opening, but after about half an hour, that is, when the first M30 candle closes. In accordance with current statistics, during the first 30 minutes, gaps do not constantly tend to close, that is, after such a jump occurs, in the vast majority of cases it begins to move in its direction, but not in the direction of closure.

How to define it?

Once you understand what a gap is in the Forex market, you will need to learn how to define it. In other words, you will need to determine whether the distance between Friday's market closing price is greater than Monday's opening price by more than 20 points. If there is at least such a difference, then it is quite possible to say that the gap has taken place.

Now we need to find an opportunity to get on sale. Half an hour later, we begin to enter the market after the first M30 candle closes, and here we need to understand the goal and the “take profit” point.

It is immediately worth noting the fact that the closing point on Friday is not taken into account in this case, but a point slightly higher or lower compared to the last closed candle is taken. That is, if the gap was up, then the closest point will be higher compared to Friday’s closing value, and the take profit point will be set just above it.

"Stop Loss"

Now you will need to decide where the stop loss is. As many have noticed, before the desire to close the gap, the price behaves quite chaotically, that is, it begins to go in a completely different direction. This happens for the reason that many begin to try to trade at the closing of gaps, but at the same time professional market makers try to knock such traders out of the market as effectively as possible. That is why such fluctuations need to be taken into account in the “stop loss” in order not to subsequently fly out of the market, but at the same time ensure good profitability of the system. Thus, if the stop is too large, then if 70% of the total number of trades are profitable, you may end up in the red.

Thus, the “stop loss” should be approximately one and a half times larger compared to the “take profit” value.

If the stop is larger, then in this case you will simply lose all the profitability of this system, and if the stop is smaller, it can simply be knocked out, as a result of which you will suffer noticeable losses. If we are not yet well versed with the concept of a gap in the Forex market, it is worth acting according to this standard. The only thing you can do is round it up and then add a couple more points that will take into account all possible fluctuations.

How will it look like?

In the vast majority of cases, over a certain period of time, the price does not move in our direction, but does not touch the “stop loss”, as a result of which the gap closes. It often happens that gaps close quite quickly, within a few hours, but situations often occur when they remain open for a long time, up to a day. Thus, if the jump was not closed instantly, then there is nothing to worry about, that is, this is a completely normal moment.

Important!

In the event that the first M30 candle closed, but it was constantly moving towards the gap, and your distance to the target is very small, such trades should not even be opened. If you don’t have a possible goal before closing at least about 20 points, then it’s better not to get into the market at all. Of course, later the market will be able to completely close such a gap, and you will have a profit of 13 points, but in fact, you should not take unnecessary risks, because in this case the goal does not justify the investment at all.

This strategy is quite easy, but in most cases it turns out to be profitable for the trader.

Are there any disadvantages?

The disadvantage of this strategy is that the opening of transactions will not occur as often as many would like, since gaps occur no more often than once a week or even a month. But at the same time, in this case you have a great chance to earn extra money. Of course, you can develop a unique trading strategy, but at the same time check once a week whether there has been a strong jump in price, periodically opening a position using such a system.

This article will discuss the types of gaps and how to trade them.

Gap(from English) gap- gap). The price gap between the previous and present unit (bar, candle, etc.) of the analyzed time period (timeframe).

Typically, gaps appear:

- as a reaction to market news;

- in the periods between the beginning and end of the session;

- as a result of infrastructure failures of the exchange;

- before or after clearing on futures.

Gaps can be both up and down. Let's look at the types of gaps.

— this is the gap between the price minimum and the previous candle’s maximum.

gap up

gap up — this is the gap between the price high and the low of the previous candle.

gap down

gap down Gaps in technical analysis are assigned predictive properties.

Types of gaps.

occurs in a flat when there is less than average trading volume.

simple gap

simple gap Gap when a level is broken— occurs after the price has been traded at the level. Sharply and in large volumes.

gap when level breaks

gap when level breaks - occurs when a trend has already formed, accelerating it.

acceleration gap

acceleration gap - indicates a price reversal, with a sharply increased volume.

gap exhaustion

gap exhaustion — usually consists of a group of candles. Indicates a market reversal.

island gap

island gap There is a postulate in classical technical analysis: “Gaps almost always close.” Yes, they are closing. But it is unknown how long it will take for the gap to close. It may close instantly, or maybe in a year/s. Therefore, I would be more careful about this statement. To avoid the trap that I described in the article “

A gap in trading (from the English gap - “gap”) is a price gap between the previous and current candles, on which there are no trading transactions. You can see how the gap occurs in the figure.

Gaps can be of the following types:

- Regular gap. Regular gaps are a common occurrence in the market. Refers to the main price movement. Typical for short-term trading with a time frame of 1-10 minutes.

- Gap during breakouts. The name itself suggests that such gaps occur when the most significant support or resistance levels are broken. With such breakouts, the price moves abruptly either up or down in a short period of time. The more orders accumulate near a support or resistance level, the sharper the price movement will be when this level is broken. A large accumulation of orders is not a rare phenomenon, since most traders see strong levels. More details about this here:

- Gap of exhaustion. Occurs during a continuously long upward or downward trend. If a gap occurs, this indicates the end of the trend and the beginning of large sales or purchases. In most cases, this situation leads to a trend reversal, since the price curve is either very high or very low.

Reasons for formation

There are several main reasons for the formation of gaps:

- News gap. News is the most common reason for new gaps to appear. An important economic or political situation that could seriously affect the stock or currency pair market makes investors more cautious or bolder in their actions. Learn more about the importance of news for the market:

- Gap due to force majeure situations. In the currency and stock markets there is always a coefficient of uncertainty that cannot be foreseen. These include natural and man-made disasters and terrorist attacks. All this is impossible to predict.

- Session and timeframe gaps are typical for stock markets and commodity exchanges. This is a gap that forms at the beginning of the trading week or after holidays. The accumulated orders will influence the market at the current moment by forming a gap.

Gaps in Forex are characterized by a sharp change in price movement, and this is the time for certain actions on the part of traders.

There are 3 possible reactions from traders:

- Active reaction. In most cases, after a gap, the price returns and traders open a trade. This advice is advisory in nature. Maybe, trading strategy trader says the opposite.

- Passive reaction. The trader is in a wait-and-see position or temporarily suspends his activities, waiting for a more stable state in the market.

- Forced reaction. Sometimes the price falls so low that in order not to lose even more, you have to close the sell trade in the red. It is important to determine for yourself how much you can lose from a transaction. By closing the deal earlier, the price may begin to rise again.

What is a gap on the stock exchange?

The main difference from the Forex market is that the commodity exchange does not operate around the clock.

Gaps, characteristic of stock markets and commodity exchanges, are formed:

- between the closing of yesterday and the opening of today's trading sessions;

- at the beginning of a new trading week;

- after holidays.

Gaps on the stock exchange correspond to Forex gaps; in addition, there are those that were formed due to the price difference between trading sessions.

conclusions

A gap on Forex and a gap on the stock exchange are good indicators of the direction of movement, indicating the beginning and end of a trend, and its reversal. Understanding the gap can become an indispensable assistant for traders specializing in long-term transactions.

For short-term transactions, gaps can also be useful; it is necessary to anticipate the possibility of the price returning to its previous values after the gap and try to determine the reason for their occurrence.