Accounting for settlements with the budget for taxes and fees. Calculations with the budget for taxes and fees Accounting for calculations for taxes and fees

Account 68 “Calculations for taxes and fees” is intended to summarize information about settlements with budgets for taxes and fees paid by an organization, and taxes with employees of this organization.

Account 68 “Calculations for taxes and fees” is credited for the amounts due under tax returns (calculations) for contributions to budgets (in correspondence with score 99"Profits and losses" - for the amount of income tax, with score 70“Settlements with personnel for wages” - for the amount of income tax, etc.).

The debit of account 68 “Calculations for taxes and fees” reflects the amounts actually transferred to the budget, as well as the amounts of value added tax written off from accounts 19"Value added tax on acquired assets."

Analytical accounting for account 68 “Calculations for taxes and fees” is carried out by type of tax.

Account 68 "Calculations for taxes and fees"

corresponds with accounts

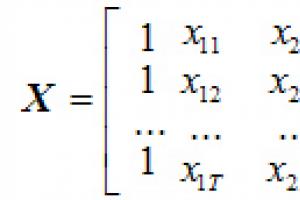

| by debit | on loan |

|

19 Value added tax on acquired assets 50 Cashier 51 Current accounts 52 Currency accounts 55 Special bank accounts 66 Calculations for short-term loans and borrowings 67 Calculations for long-term loans and borrowings |

08 Investments in non-current assets 10 Materials 11 Animals for growing and fattening 15 Procurement and acquisition of material assets 20 Main production 23 Auxiliary productions 26 General expenses 29 Service industries and farms 41 Products 44 Selling expenses 51 Current accounts 52 Currency accounts 55 Special bank accounts 70 Settlements with personnel for wages 75 Settlements with founders 90 Sales 91 Other income and expenses 98 Deferred income 99 Profit and loss |

Application of the chart of accounts: account 68

- How to return overpayment of taxes and fees

To identify overpayments, you need to analyze account 68 “Calculations for taxes and fees”. Having generated an analysis of the account according to those shown in Fig. " Calculations for social insurance and security." Similar to account 68, we check the data...

- Advance payments for income tax. Examples

For income tax in correspondence with account 68 "Calculations for taxes and fees" (Instructions for using the Chart of Accounts... of income tax expenses) in correspondence with the credit of account 68, subaccount "Calculations for tax... advance payment for income tax based on the results of the first quarter 68 "Calculation of tax on... profit" 51 25 400 Bank statement on the current account... what is in the accounting for account 68, subaccount "Calculation of income tax" should...

- Inseparable improvements. Accounting and tax accounting for the lessor

... ;Value added tax on acquired assets" in correspondence with the debit of account 68 ... "Calculations for taxes and fees." Corporate income tax Capital... accounting by the debit of account 09 "Deferred tax assets" and the credit of the account 68, and... repayment - by entry on the credit of account 09 and the debit of account 68 (Instructions for using the Chart of Accounts...

- Temporary tax differences: causes and accounting features

Liabilities (IT) are accounted for in the debit of account 68 “Calculations for taxes and fees, subaccount for accounting for calculations of income tax” in correspondence... with the credit of account 77 “Deferred...” in correspondence with the credit of account 68 “Calculations for taxes and fees, subaccount for accounting for income tax calculations.” There will be postings...

- In which account (91 or 99) should sanctions for violation of tax laws be reflected?

Account 99 “Profits and losses” in correspondence with account 68 “Calculations for taxes and fees”. According to... “Profits and losses” in correspondence with account 68 “Calculations for taxes and fees”. Justification... "Profits and losses" in correspondence with account 68 "Calculations for taxes and duties" in... illegal (in violation of the legislation on taxes and duties) act (action or inaction) of the taxpayer...

- Risks for chief accountants are increasing

Judges also find it natural, without taking into account at all who... reporting, it is understood: understating the amounts of taxes and fees on at least 10... accounts 68 “Calculations for taxes and fees” and 19 “Value added tax on acquired values”, resulting in an underestimation of the amounts of taxes and fees... declaration (calculation) and payment on the basis of such a tax return (calculation) of the unpaid amount of tax (fee) ... enough rights, because the payment of taxes (fees) and penalties is within the competence leader...

- Reflection of fines for violation of tax laws in accounting

Penalty for violation of legislation on taxes and fees (fine). Which accounting entries... about taxes and fees (fine). What accounting entries need to be made in this case? According to... “Profits and losses” in correspondence with account 68 “Calculations for taxes and fees”. Justification... "Profits and losses" in correspondence with account 68 "Calculations for taxes and duties" in... illegal (in violation of the legislation on taxes and duties) act (action or inaction) ...

- Accounting for factoring companies attracting external financing

Date of registration of goods and receipt of invoice 68/VAT (calculations for taxes and duties) 19 (VAT on purchased values... date of registration of goods and receipt of invoice 68/VAT (calculations for taxes and duties) 19 (VAT on purchased valuables... date of registration of goods and receipt of invoice 68/VAT (calculations of taxes and duties) 19 (VAT on purchased valuables...

- Payment for third parties: how to make and process

In which the only current account was opened, the license was revoked. Therefore, the enterprise... to which it indicates: the obligation for the fulfillment of which the payer makes a transfer... to the person does not arise. In income tax calculations, amounts paid to a third party... payments to a third party to repay the payer's debt to... 76 Credit 68 – the repaid debt of a third party on taxes and fees is recorded; Debit 60 ... taxes for individuals. Tax agents cannot pay personal income tax at the expense of...

- Correcting errors in accounting and reporting

96,000 (according to other calculations of the year preceding the reporting year, according to other past financial...: a) by reflecting entries in accounts accounting the last date of the reporting... years (clauses 31, 52, 68 of Instruction No. 33n); 2) incoming... reporting periods (clauses 15, 68 of Instruction No. 33n). Adjustments to incoming... also apply to updated calculations of fees and insurance premiums. * * * For errors... in accounting statements, understatement of taxes and fees, insurance premiums, an autonomous institution...

- Major bug fixes

Based on rent for September 2015; Debit of account 68 “Calculations with the budget for taxes and fees”, subaccount “Calculations for... VAT”, Credit of account 19 “Added Tax... for rent for September 2016; Debit of account 68 “Calculations with the budget for taxes and fees”, subaccount “Calculations for... VAT”, Credit of account 19 “Added Tax...

- Imported goods have spoiled: how to take into account customs VAT, disposal costs and insurance compensation

Customs broker, insurance, transportation, customs duty and customs VAT, calculated in proportion to the quantity... deductible. Income tax The object of taxation and the tax base for income tax... 68 Credit 19 - VAT is accepted for deduction; Offsetting the claim against settlements with... ;Calculations on claims" Credit 19 - the amount of customs VAT and on account... 68 is written off against the claim; Credit 19 - VAT is accepted for deduction; Debit 76, subaccount "Settlements on...

Since 2014, tax revenue growth has amounted to 68.3%, the same... times, including 68.3% in just the past five... . units

Tax accounting at the enterprise is carried out in accordance with the methodological principles and rules established by the Tax Code of the Russian Federation.

The payment of many taxes (VAT, excise taxes, personal income tax, etc.) is regulated by Part 2 of the Tax Code of the Russian Federation. For each tax the following are established:

object of taxation;

the tax base;

taxable period;

tax rate;

tax calculation procedure;

procedure and deadlines for tax payment;

tax benefits.

To summarize information about settlements with budgets for taxes and fees paid by an organization, and taxes with employees of this organization, account 68 “Calculations for taxes and fees” is intended.

A special place in the tax legislation system is occupied by a single tax on imputed income for certain types of activities in the small business system. Imputed income is the potential gross income of the payer of this tax, excluding possibly necessary expenses supported by documents.

Payers of this tax are legal entities and individuals carrying out business activities in certain areas (accounting, auditing, transport and other services), for which a strictly fixed number is established.

If an organization or entrepreneur has several retail outlets or other places where their activities are carried out, then the calculation of the amount of the single tax is presented for each of such places.

The tax period for the single tax is determined to be one quarter. The amount of the single tax is calculated taking into account the rate, the value of the basic profitability, the number of physical indicators influencing the results entrepreneurial activity, decreasing (increasing) coefficients of basic profitability, established depending on specific business conditions (place of implementation - center, outskirts, seasonality, daily work hours, etc.).

An accounting entry is made for the amount of the calculated single tax on imputed income:

Debit 99 “Profits and losses”

Credit 68 “Calculations for taxes and fees”

Repayment of debt for this tax is made quarterly in the form of an advance payment in the amount of 100% of the amount of the single tax for the quarter. According to the bank statement, an entry is made in the accounting records for the amount of the transfer:

Debit 68 “Calculations for taxes and fees”

Credit 51 “Current accounts”.

To reflect in the accounting of business transactions related to the Value Added Tax, account 19 “Value Added Tax on Acquired Values” and account 68 “Calculations for Taxes and Fees”, subaccount “Calculations for Value Added Tax” are intended. Account 19 has the following subaccounts:

- 1 “Value added tax on the acquisition of fixed assets”;

- 2 “Value added tax on acquired intangible assets”;

- 3 “Value added tax on purchased inventories.”

In the debit of account 19 for the corresponding subaccounts, the customer organization reflects the tax amounts on purchased material resources, fixed assets, intangible assets in correspondence with the credit of accounts 60 “Settlements with suppliers and contractors”, 76 “Settlements with various debtors and creditors”, etc.

For fixed assets, intangible assets and inventories, after they are registered, the amount of VAT recorded on account 19 is written off from the credit of this account depending on the direction of use of the acquired objects to the debit of the accounts:

68 “Calculations for taxes and fees”;

accounting for sources of covering costs for non-productive needs (29.91, 86) - when used for non-productive needs;

91 “Other income and expenses” - when selling this property. Tax amounts on fixed assets, intangible assets, other property, as well as on goods and material resources (work, services) to be used in the manufacture of products and operations exempt from tax are written off as a debit to production cost accounts (20 “Basic production", 23 " Auxiliary production", etc.), and for fixed assets and intangible assets - taken into account together with the costs of their acquisition.

When selling products or other property, the calculated tax amount is reflected in the debit of accounts 90 “Sales” and 91 “Other income and expenses” and the credit of account 68, subaccount “Calculations for value added tax” (for sales “on shipment”), or account 76 “Settlements with various debtors and creditors” (when selling “on payment”). When using account 76, the amount of VAT as a debt to the budget will be accrued after the buyer pays for the products (debit account 76, credit account 68). Repayment of debt to the budget for VAT is reflected in the debit of account 68 and the credit of accounting accounts Money.

The procedure for accounting for income tax calculations is determined by PBU 18/02. This PBU introduced nine new indicators into accounting practice, each of which increases or decreases taxable profit or payable tax:

permanent differences;

temporary differences;

ongoing tax obligations;

deferred income tax;

Deferred tax assets;

deferred tax liabilities;

conditional income;

conditional consumption;

Current income tax.

Permanent differences are income and expenses that are taken into account in accounting, but are not taken into account in tax accounting. Permanent differences include:

the amount of excess of actual expenses reflected in accounting records over expenses according to the norms adopted for tax purposes (for daily living expenses, entertainment expenses, expenses for certain types of voluntary insurance and certain types of advertising, interest on loans and credits);

expenses for the gratuitous transfer of property;

a loss carried forward but which, after the lapse of time, cannot be accepted for tax purposes;

other types of permanent differences.

For gratuitously transferred property, the amount of permanent differences is determined by summing the cost of the transferred property with the costs associated with this transfer.

Current income tax is the income tax payable to the budget in the reporting period. It is calculated based on the amount of the conditional expense adjusted to the amounts of permanent tax liabilities, deferred tax assets and deferred tax liabilities of the reporting period. Current tax loss is a profit tax calculated on the basis of conditional income and specified adjusting values. The procedure for calculating the current income tax and current loss tax can be presented as follows:

Current income tax (current tax loss) = Notional income tax expense (notional income) + permanent tax liabilities + Deferred tax assets - Deferred liabilities

According to the above diagram, the amount of current income tax can be calculated using the following data:

about tax assets and tax liabilities;

about differences arising in reporting periods.

Along with being reflected in the balance sheet, deferred tax assets and deferred tax liabilities are indicated in the income statement. This report also contains data on ongoing tax liabilities.

When calculating income tax, account 99 “Profits and losses” is debited and account 68 “Calculations for taxes and fees” is credited. Tax penalties due are recorded in the same accounting entry. The listed amounts of tax payments are written off from the current account or other similar accounts to the debit of account 68.

Accounting for settlements of organizations with the budget for corporate property tax is kept on account 68 “Calculations for taxes and fees” in a separate subaccount “Calculations for property tax”.

The accrued tax amount is reflected in the credit of account 68 “Calculations for taxes and fees” and the debit of account 91 “Other income and expenses”. The transfer of the amount of property tax to the budget is reflected in accounting as the debit of account 68 “Calculations for taxes and fees” and the credit of account 51 “Calculation accounts”.

The transport tax introduced replaced the tax on vehicle owners, the tax on road users and the property tax on individuals in relation to vehicles.

Payers of transport tax are organizations and individuals on whom vehicles that are subject to taxation are registered.

Tax rates are set by subjects Russian Federation depending on engine power or gross tonnage of vehicles, category of vehicles per horsepower of engine power vehicle, one registered ton of a vehicle or a unit of a vehicle based on the rates established by the Tax Code of the Russian Federation.

Transport tax payments are included by the payer in the cost of products (works, services). Tax accrual is reflected in the debit of accounts 26 “General business expenses”, 44 “Sales expenses” and other accounts and the credit of account 68 “Calculations for taxes and fees”, subaccount “Calculations for tax on highway users”.

The company's production and economic activities are subject to thorough analysis, and all operations performed are recorded in accounting accounts, incl. calculation and payment of taxes. Article 12 of the Tax Code of the Russian Federation establishes several level categories of taxes that determine the corresponding budgets: federal, regional, local. Let's understand the features of accounting.

Calculations for taxes and duties: invoice

Accounting for calculations of taxes and fees is regulated by legislative norms and current regulations. In accounting, all taxes and established fees are recorded on account 68 “Settlements with the budget for taxes and fees », where for each of them a sub-account is specially opened that combines analytical information. Account 68 is intended to summarize in general information on taxes paid by the company, as well as by the company’s personnel. Note that only in VAT accounting, in addition to 68, account 19 is also used. With its help, input VAT on purchased values is reflected.

The taxation system chosen by the enterprise dictates the calculation of this or that tax, but they are all taken into account according to one rule: accruals payable to the budget are recorded as a credit to account 68, and the transfer of payments for them, i.e. payment, is recorded as a debit. Analytics is necessarily carried out by type of tax deductions, providing the ability to obtain operational information on made, overdue or deferred payments, as well as accrued fines and penalties.

Depending on the type of fees, the corresponding accounts to the 68th account may be:

- accounts of production costs when calculating taxes included in the cost of manufactured products/services (transport, land, water, fees for emissions in environment, for the purchase of a vehicle, etc.) – D/t 08/20/23/25/26/29/44/97 – K/t 68;

- profit before tax (when property taxes, advertising tax, etc. are calculated) D/t 91 – K/t 68;

- sales accounts and other expenses (when calculating VAT, excise taxes) D/t 90.91 – K/t 68;

- effective accounts (when calculating income tax) D/t 99 – K/t 68;

- income accounts of individuals (when paying personal income tax) D/t 70 – K/t 68;

- accounts for other expenses or compensation for damage when calculating penalties for non-payment or partial payment of taxes: D/t 91 (73 for personal liability) - K/t 68. By recording D/t 91 - K/t 68, payment of the state duty is made for consideration of the case in court

To transfer the payment, an entry D/t 68 – K/t is drawn up. The entry D/t 51 – K/t 68 reflects the amounts returned for overpayment of taxes.

When summing up the results for the period under review, the balance of account 68 for individual subaccounts can be expanded, i.e., debit and credit. This is often necessary to make the data provided to users more informative.

Calculations of taxes and fees in the balance sheet

Being an active-passive account, account 68 unites all the activities of the company and reflects settlements with the budget for taxes and fees, both in the active part of the balance sheet and in the liability side. Information related to tax payments may be reflected in the balance sheet in the following sections and lines:

- in the balance sheet asset:

- in the 1st section:

- line 1180 when accounting with deferred tax assets,

- in the 2nd section:

- page 1220 “VAT on purchased MC”:

- page 1230, if the company has overpaid tax payments;

- in the 1st section:

- in the liabilities side of the balance sheet:

- in section 4:

- line 1420 in the presence of deferred tax liabilities;

- page 1450, if there are long-term obligations for the installment plan/deferment of taxes provided to the company, investment loan projects, etc.;

- in section 5:

- p. 1520 when reflecting accounts payable for short-term arrears and accrued taxes for which the payment period has not yet arrived.

- in section 4:

To reflect in the accounting of business transactions related to VAT, accounts 19 “VAT on acquired values” and 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT” are intended.

Account 19 has the following subaccounts:

19-1 "VAT on the acquisition of fixed assets";

19-2 "VAT on acquired intangible assets";

19-3 "VAT on purchased inventories."

In the debit of account 19 for the corresponding subaccounts, the customer organization reflects the amounts of VAT on purchased materials, fixed assets, intangible assets in correspondence with the credit of accounts 60 “Settlements with suppliers and contractors”, 76 “Settlements with various debtors and creditors”, etc.

For fixed assets, intangible assets and inventories, after they are registered, the amount of VAT recorded on account 19 is written off from the credit of this account depending on the direction of use of the acquired objects to the debit of the accounts:

68 “Calculations for taxes and fees” - for production use;

accounting for sources of covering costs for non-productive needs (29, 91, 86) - when used for non-productive needs;

91 “Other income and expenses” - when selling this property.

Tax amounts on fixed assets, intangible assets, other property, as well as on goods and material resources (work, services) to be used in the manufacture of products and operations exempt from tax are written off as a debit to production cost accounts (20 "Basic production", 23 "Auxiliary production", etc.), and for fixed assets and intangible assets - taken into account along with the costs of their acquisition.

When selling products or other property, the calculated tax amount is reflected in the debit of accounts 90 “Sales” and 91 “Other income and expenses” and the credit of account 68, subaccount “VAT Calculations”. When using account 76, the amount of VAT as a debt to the budget will be accrued after the buyer pays for the products (debit account 76, credit account 68). Repayment of debt to the budget for VAT is reflected in the debit of account 68 and the credit of cash accounting accounts.

Income tax accounting

Profit tax is paid from the profit of the enterprise. According to Chapter 25 of the Tax Code of the Russian Federation, profit is the income received, reduced by the amount of expenses incurred. The tax rate is 24%. An accountant should reflect income tax as follows:

Calculate tax on accounting profits;

Adjust it so that you get the amount recorded in the declaration.

Tax on accounting profit (loss) is otherwise called contingent income tax expense (income).

To reflect these amounts, a special sub-account “Conditional income tax expense (income)” is created in account 99. Based on the results of the reporting period, an entry is made: Debit 99 subaccount “Conditional income tax expense (income)” Credit 68 - conditional income tax expense has been accrued, or Debit 68 Credit 99 subaccount “Conditional income tax expense (income)” - conditional income tax income has been accrued.

This amount must then be adjusted.

Permanent tax liabilities arise if a company makes expenses that do not reduce taxable income. A permanent difference is the difference between the amounts of a given type of expense recognized in accounting and tax accounting: Debit 99 subaccount “Permanent tax liability” Credit 68 - reflects the permanent tax liability that arose in this reporting period.

Advance transfers of income tax are reflected: Dt 68 Kt 51. Tax accrual on actually received profit: Dt 99 Kt 68. Additional transfer of tax: Dt 68 Kt 51 rub.

Property tax accounting

Property tax is calculated in the following sequence:

1. The residual value of the property is calculated on the first day of each month;

2. The average annual value of property is calculated for each tax period (first quarter, half a year, 9 months;

3. The amount of tax that needs to be paid to the budget at the end of the reporting period (quarter, half-year and 9 months) is calculated;

4. The amount of tax that needs to be paid to the budget for the entire year is calculated.

The residual value of the property is calculated according to the following scheme:

To calculate the amount of tax that needs to be paid to the budget for the reporting or tax period (Q1, half-year, 9 months, year), you need to determine the average annual value of the company’s taxable property for this period:

During the year, firms make advance tax payments for each accounting period. At the end of the year, companies finally settle their taxes with the budget. The amount of tax that needs to be paid to the budget at the end of the reporting period (quarter, half-year and 9 months) is determined according to the following scheme:

The amount of tax that needs to be paid to the budget for the entire year is calculated according to the following scheme:

Accounting for settlements with the budget for property tax is kept on account 68 “Calculations for taxes and fees”, subaccount “Calculations for property tax”. The accrual of the amount of property tax is reflected in D 91 - K 68. The transfer of the amount of property tax to the budget is reflected in the accounting entry: D 68 - K 51.

Accounting for personal income tax

The most common withholding wages is personal income tax. When determining the tax base for personal income tax, all income of the taxpayer received both in cash and in kind is taken into account.

As a rule, tax is withheld at a rate of 13% on part of the income received by individuals (salaries and other payments made to employees, remuneration for work performed, etc., with the exception of other income for which other rates are established);

When determining the tax base, the taxpayer has the right to receive tax deductions: standard, social, property and professional. An enterprise can provide only standard deductions and property deductions (upon notification from the Federal Tax Service).

Standard deductions are provided to the employee on the basis of a written application and documents confirming the right to such tax deductions.

Tax deduction in the amount of 400 rubles. for each month of the tax period provided to the employee, it is valid until the month in which the employee’s income, calculated on an accrual basis from the beginning of the tax period, exceeds 20,000 rubles.

Tax deduction in the amount of 600 rubles. for each month of the tax period applies to:

1) each child of taxpayers who support the child and who are parents or spouses of parents;

2) each child of taxpayers who are guardians or trustees, adoptive parents.

Tax deduction in the amount of 600 rubles. valid until the month in which the employee’s income, calculated on an accrual basis from the beginning of the tax period, exceeds 40,000 rubles.

A tax deduction is made for each child under the age of 18, as well as for each full-time student, graduate student, resident, student, cadet under the age of 24 from parents (trustees).

Specified tax deduction doubles in the following cases:

1) if a child under 18 years of age is disabled;

2) if a full-time student, graduate student, resident, student under the age of 24 is a disabled person of the 1st or 2nd group;

3) if the employees are single parents, trustees, guardians or adoptive parents of a child.

In accounting, personal income tax accounting transactions are reflected by the following entries:

D-t 70 K-t 68 - personal income tax is withheld from the salary; D 51 K 68 - personal income tax transferred to the budget

Excise tax accounting

For To account for settlements with the budget for excise taxes, account 19 “Value added tax on acquired assets”, subaccount 5 “Excise duties on paid material assets” and account 68 “Calculations for taxes and fees”, subaccount “Calculations for excise taxes” are used.

The amount of excise taxes paid by suppliers for excisable goods used as raw materials for the production of excisable goods for which the excise payment is counted is reflected by the organization in the accounting entry: D 19-5 - K 60, 76. The amounts of excise taxes provided for as part of the proceeds from the sale of goods are including those produced from customer-supplied raw materials, are reflected: D 90 - K 68.

Amounts of excise taxes on material assets accounted for in the debit of account 19-5 are written off to reduce the debt to the budget for excise taxes as capital assets received and paid for production are written off from the credit of account 19-5 to the debit of account 68.

If, for tax purposes, proceeds from sales are accepted as they are paid, the amount of excise taxes to be received from buyers and customers is taken into account on the credit of account 76, the subaccount “Settlements with the budget for excise taxes” and the debit of account 90. When paying for products, the amount of excise taxes is debited from the account 76 to the debit of account 68.

The transfer of advance payments of excise taxes to the budget on excisable goods subject to mandatory marking with excise duty stamps of the established form is reflected by an entry on the credit of cash accounting accounts in correspondence with the debit of account 97 “Deferred expenses”, subaccount “Advance payment of excise taxes in the form of the sale of excise duty stamps” collection." As goods subject to marking with excise duty stamps are sold, the amount of excise taxes is reflected in the accounting entry: D 90 - K 68. At the same time, the advance payment in relation to the costs incurred for the sale of excisable goods with excise duty stamps affixed is written off from the credit of account 97 to the debit of account 68 .

The actual cost of excisable goods (excluding excise taxes) used for the production of other goods not subject to excise taxes is reflected in the credit of accounts 21 “Semi-finished products of own production” or 43 in correspondence with the debit of account 20. At the same time, for these goods the calculated amount of excise taxes is reflected in the credit of account 68 in correspondence with the debit of account 20; excise tax amounts transferred to the budget - on the debit of account 68 in correspondence with the credit of account 51.

Accounting for other taxes and fees

A tax is a mandatory contribution to the budget by payers. The procedure and terms of payments are determined by legislative acts. Account 68 “Calculations for taxes and fees” is the main passive account. The credit of the account reflects the accrual of payments due to the budget, and the debit reflects the repayment of debt. If an enterprise overpays taxes, the balance may be a debit, that is, the budget receivables to the enterprise are reflected. As part of the account. 68 sub-accounts are opened by type of payment: 68/1 - income tax calculations; 68/2 -- calculations for value added tax; 68/3 -- calculations for excise taxes; 68/4 -- calculations for personal income tax; 68/5 -- calculations for property tax and so on by type of payment.

To correctly calculate tax, you need to know the main indicators: 1. Object of taxation. 2. The payment base, that is, the quantitative value of the taxable object. 3. Tax rate. 4. Source of payment. All types of taxes are grouped by sources of tax payment: a) production costs; b) wages; c) selling price; d) other expenses of the organization; e) financial results. Land tax is included in production costs and distribution costs.

Other expenses of the organization include corporate property tax and advertising tax.

Everyone is a property tax payer. legal entities(except for budgetary organizations, government bodies, public organizations disabled people, etc.). The object of taxation is the value of the property. The tax base is the average annual cost of fixed assets, intangible assets minus depreciation, inventories and costs on the balance sheet of the enterprise. Rates are set at the level of the subjects of the Federation, the marginal rate is 2.2%.

Corresponding accounts are drawn up for the listed taxes: tax accrual Dt 91 Kt 68; transfer of taxes Dt 68 Kt 51.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Similar documents

Economic essence taxation, functions, classification and fee system in Russia. Monitoring the organization of settlements for taxes reimbursed from costs; from proceeds; paid from net profit and income of individuals.

course work, added 01/19/2011

Taxes: concept and functions. Formation of the tax system of the Republic of Belarus. Accounting for settlements with the budget for taxes and fees calculated from the organization’s revenue and profit, ways to improve them. Reporting on settlements with the budget for taxes and fees.

course work, added 06/01/2012

Theoretical and methodological aspects of accounting of an organization's calculations for taxes and fees, as well as accounting and control of organizations' calculations for taxes and fees. Monitoring the practical implementation of taxation in the Russian Federation.

course work, added 01/04/2009

Assessment of the place and importance of calculations for taxes and fees in the economic activities of commercial organizations. Tax systems, types of taxes and sources of their payment, principles for calculating amounts. Reflection of their payment in the enterprise’s reporting.

course work, added 04/10/2014

Legal and theoretical justification for organizing accounting of settlements with the budget for taxes and fees. Organization of accounting of settlements with the budget for taxes and fees in Tekhnik LLC. Analytical and synthetic accounting of budget calculations.

course work, added 09/17/2014

Essence, types and elements of tax accounting. Concept, forms and composition of tax reporting. Synthetic and analytical accounting of calculations for taxes and fees at Versales LLC. The procedure for calculating taxes and improving accounting in the organization.

course work, added 12/10/2011

Conceptual apparatus and legal regulation of taxes and fees in the Russian Federation. Methodology for conducting an audit of settlements with the budget. International practice of accounting for tax calculations. Audit at Stroypodryad LLC, Krasnodar.

course work, added 05/18/2016